The Job of the Treasurer:

A treasurer manages the everyday activities of an organization’s finances. This includes paying bills and recording them. Also taking care of the cash flow and making a record of the organization’s debts. The treasurer selects a bank and at the end of the month reconciles the statements. The treasurer should also have a firm understanding of the organization’s bylaws.

A Treasurer of a 501 (c) 3 non-profit charity draft and present the annual budget to the board, prepare and present a treasurer’s report at board meetings, check accounting work for errors and fraud, sign or approve checks and other payments, and sign the annual tax return for the organization, known as a Form 990.

The treasurer works with board members, the executive director and program directors to create an overall budget (financial projection model) and specific budgets for individual programs. When creating a budget, a treasure has the best understanding of the types of expenses the organization can afford.

A treasurer’s report at a board meeting informs if the organization is in sound financial shape, consist of a beginning and ending balance for the period covering the time between two board meetings, or provide detailed income and expense information.

Treasurers may be a voting board member and are required to attend board meetings and vote on motions. They may lead or work with a finance committee.

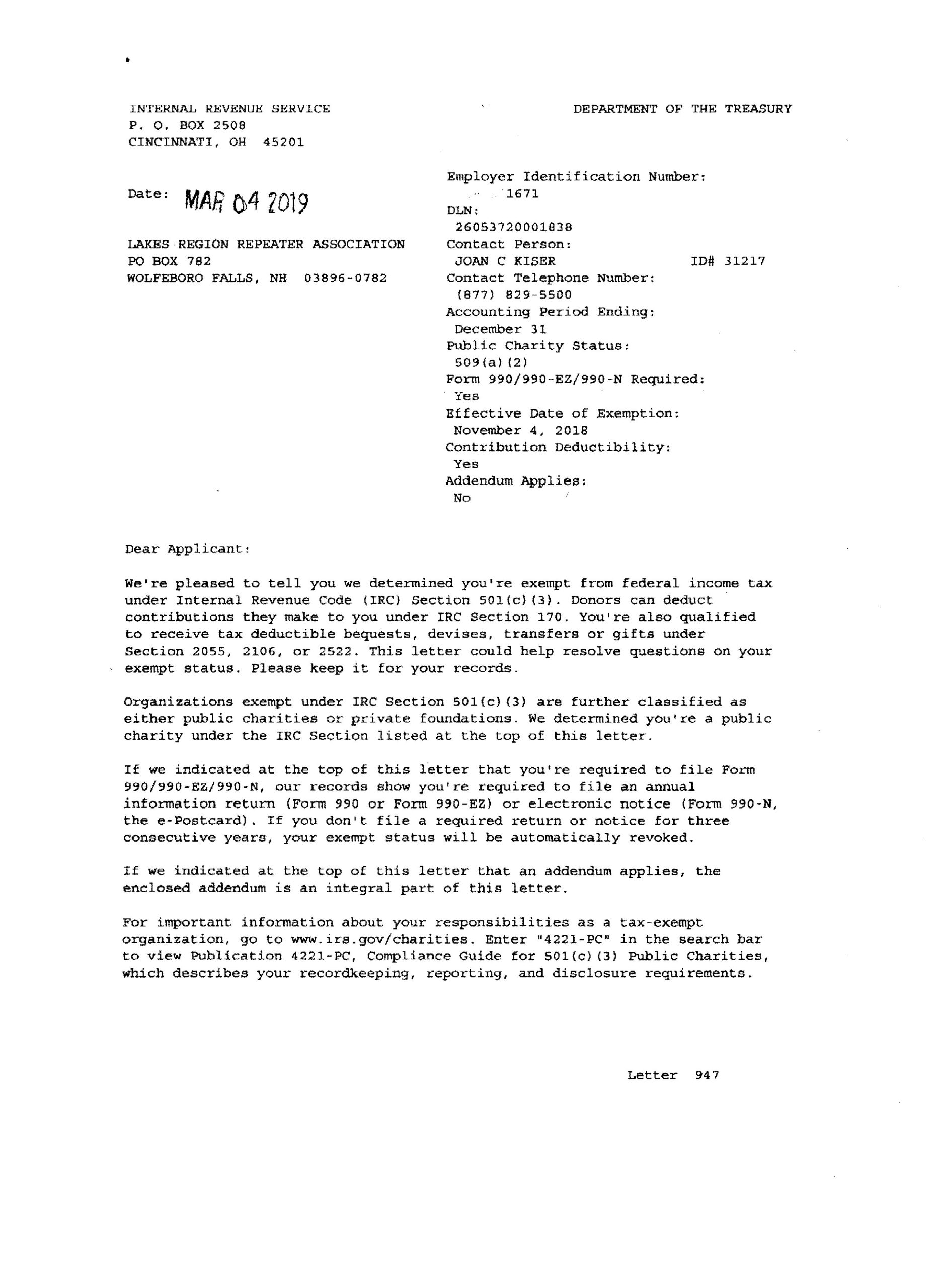

Tax-exempt organizations must do annual returns. Annual returns and exemption applications are filed with the IRS. These must be made available for public inspection.

___________________

Form 990 is an IRS form that provides the public with financial information about a non-profit. The following links are 990 (e-postcard) for the years 2018, 2019, 2020, 2021, 2022, 2023 and 2024 that provides information about our LRRA nonprofit.

__________________

Form 1023 is an IRS Application for Recognition of Exemption Under 501 of the IRS. It is filed by nonprofits to get exemption status. The following links are a 1023-EZ that provides information about our LRRA application for exemption.

____________________

IRS Determination Letter